The world is not what it was. During the first wave of the pandemic, there was an unprecedented boom in investing. And wow did fintech companies feel the love. Acquisition was high, paid media budgets were actually paying off and the flurry of activity sent sparks of excitement through the community.

But then all this changed. From April 2021 there was a huge search drop off. People weren’t losing interest, no. They had simply invested already. Nutmeg announced a record-high three billion pounds under management. But rather than indicate a loss of attention or ending of investment – this shows us just the opposite. People are engaged. Interest in investing isn’t off the radar; it’s just evolved.

However, when paid media is no longer effective and sales targets aren’t being met what do you do? Change tack. Success lies in retaining current customers and winning competitors’ customers. Paid media and SEO alone won’t cut it. But there are five things you can start doing today that will.

Start being honest about the data

We can read data in many ways, and we can certainly read our own data so we come up looking a lot better than we are. But now’s the time to start being honest. Search intent always trumps volume. You may be getting super high volumes of keywords but what are those searches actually about? If the intent is to leave, cancel or complain then the picture changes.

How do your customers really feel about you? Because if it isn’t great – they could be lost to the competition. You need to get to know your customers and create content they actually care about, served in the right place and at the right time. An integrated content marketing strategy takes into account every point in the customer decision journey and unites customer data with creative ideas that resonate. It’s not about a scattergun of paid media across the web. It’s about content that deeply engages with a customers’ interests, concerns or problems – and it’s about them reading this content when they want, how they want and where they want.

This is how you retain customers but also – just as importantly – it’s how you win competitors’ customers.

Start defining your TOV

Communicating with customers is the most important thing any brand does. And so it’s essential that communications are clear, relevant and your customer wants them. But beyond the basics, a defined tone of voice can do amazing things for you.

In a competitive landscape, you need a unique and compelling brand voice. A strong consistent voice across all of your communications establishes and maintains a relationship with your customer. And like with any relationship, they need to know who you are before they can have an opinion about you. This is essential from getting their attention, to selling, bonding and turning them into advocates.

What you say and how you say it – your voice, tone, grammar, style – has a huge impact on how your words are received and understood. And this will affect how your customers feel about you. Define who you are as a brand and then ensure this is echoed across all your communications – from social posts and welcome emails, to online forms and what influencers you work with.

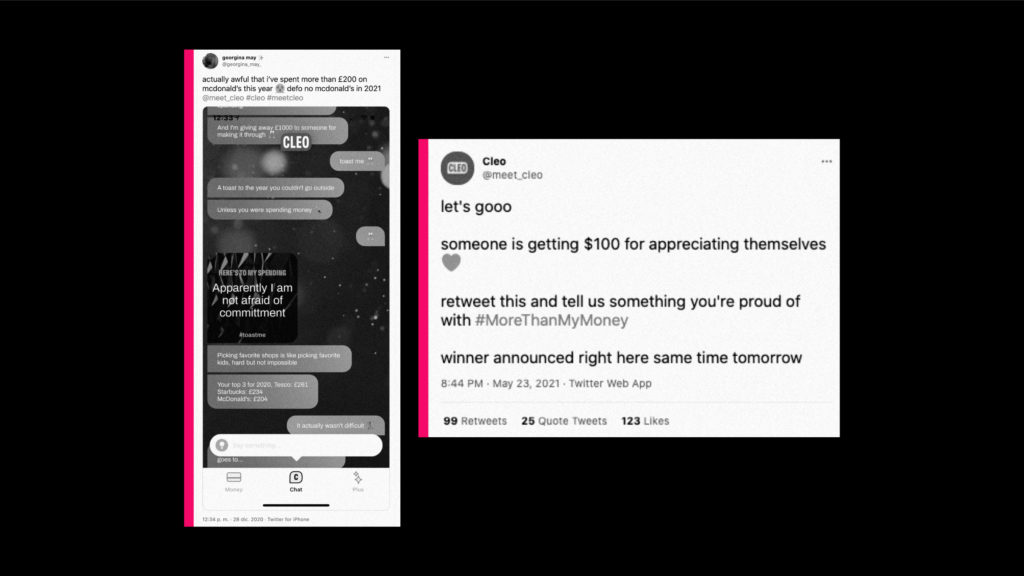

Cleo’s tone of voice builds a community around their sharable app experience – earning organic mentions as people discover the brand. They focus on looking after your well being and not being too critical of your financial situation. Our deeper analysis shows that this audience actively considers other save-the-change apps and Cleo is poised to capitalise and retain this demographic.

Start creating content that really knows the customer

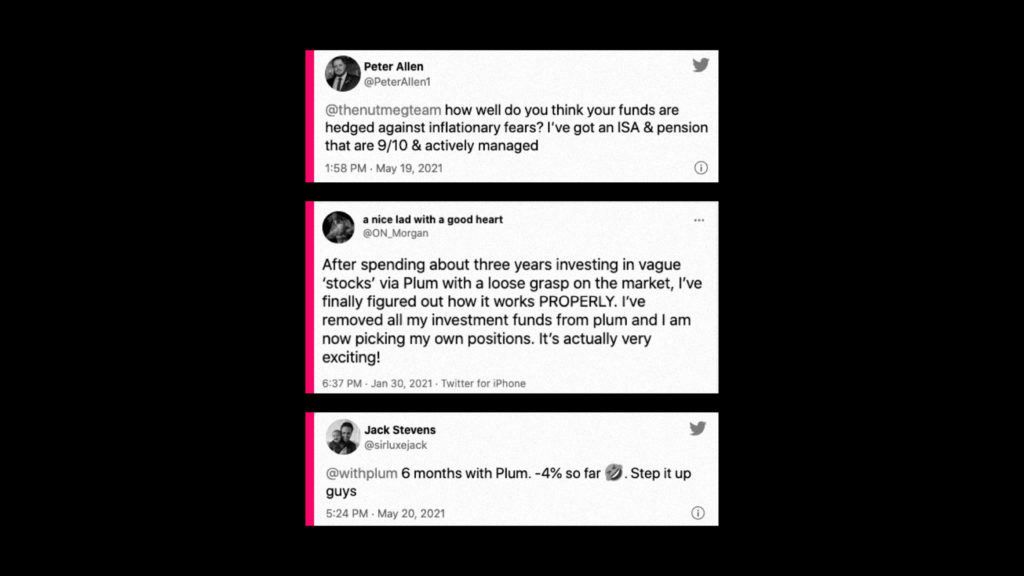

OK, so we know we need to create content the customer wants. Across many industries, including fintech, transparency is key. It’s about being an honest and authentic voice that can help or guide people. Casual investors want some autonomy. They want to know where their money is going and how it can work harder for them as well as seeking knowledge to increase their understanding. This has manifested as interest in larger, more traditional brokerages – there has been a 230% increase in mentions of AJ Bell and Vanguard in particular.

People want the power in their hands. So what’s the response? Actively engage with your community. With this insight there’s a huge variety of ways you can create content that serves this need. Whether it’s on-hand social media that answers questions in real-time. Or personalised emails that show a customer their investments and learnings. Or an influencer series on getting to the root of investing for beginners and the questions they should be asking. It could be how-to videos, myth-busting infographics, help and support articles. You get the picture. This one insight should be used as a creative jumping off point from which relevant data and beautiful creative meet.

Start creating seamless journeys

No one wants poorly targeted, irrelevant ads. Best case: customers ignore it. Worst case: they actively disengage with your brand. So what’s the solution? We already know! By asking what content your customers want, where they want it and how they want it.

A beautiful joined up online experience – which talks to the customer about what they care about, in a format and place they are comfortable with, at the right time in their day is integrated marketing in a nutshell. We move customers from:

Inspiration: with compelling, data-led creative

Consideration: with engaging content that deeply interests and provokes

Buy: with seamless UX

Bond and enjoy: with relevant and impactful content that gives customers more

Advocate: and finally they start actively engaging with you.

Act now or lose out

Now’s the time to move on. All those customers you won? Keep them. All those competitors’ customers? Win them over. Ditch the paid media. Get yourself an integrated strategy.

We’ve done an in-depth analysis of the fintech market – if you want to hear more or know our headline insights for you, just drop us a line.

Sources

- JP Morgan buys Nutmeg

- (Within the conversations of just five brands analysed over a six month period)